News Item

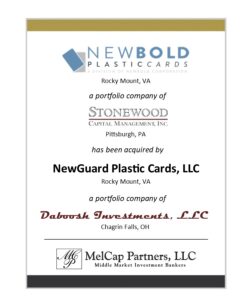

Daboosh Investments acquires NewBold Plastic Cards

Posted on December 26, 2022 by

From MelCap Partners, NewBold Corporation’s exclusive investment banker and financial advisor in the sale of PlasticCards:

MelCap Partners is pleased to announce that NewBold PlasticCards, a division of NewBold Corporation, has been acquired by Daboosh Investments, LLC.

Company Description

NewBold PlasticCards (“PlasticCards”) is the largest manufacturer of blank white and colored plastic cards in North America. PlasticCards can produce a variety of cards for several applications such as hotel keys, access cards, identification cards, and retail/gift cards. PlasticCards predominately produces graphic quality cards, but can produce a full product line of plastic cards including PVC/ PET composite, utility stress, super stress, RFID, and cards collated with a magnetic stripe overlay.

Services Provided

MelCap Partners served as NewBold Corporation’s (“NewBold”) exclusive investment banker and financial advisor in the sale of PlasticCards. We’d like to thank Keith Howerin, President and CEO of NewBold, and Stonewood Capital Management (“Stonewood”) for hiring MelCap Partners to represent NewBold in this transaction. It was an honor and pleasure to work with them throughout this exciting process.

Result

In order to focus on its core business, NewBold made a strategic decision to divest the PlasticCards business to a buyer that could provide necessary support to grow the business. MelCap Partners was able to successfully identify the best partner for the business. As a result, PlasticCards was sold to NewGuard Plastic Cards, LLC, a newly-formed portfolio company of Daboosh Investments, LLC (“Daboosh”).

Client Quote/Recommendation

Mr. Keith Howerin, President & CEO of NewBold said, “The MelCap Team exceeded our expectations throughout the deal process. Once we engaged them, it became obvious that we had chosen the right team to partner with. They did an exceptional job working with our Controller on the financial aspects of the deal. The MelCap team was professional, responsive, and offered sound guidance throughout our journey to transactional completion. My recommendation of the MelCap Team comes at the highest level!”

Deal Team

We would also like to thank the deal teams for both sides that worked on this transaction. We could not have completed this transaction without your tireless efforts. More specifically, we’d like to thank Keating, Muething & Klekamp PLL, Davidson, Doyle & Hilton, LLP, and Meaden & Moore, CPAs, as well as the Stonewood and Daboosh teams.

About MelCap Partners, LLC

MelCap Partners (www.melcap.com) is an investment banking advisory firm specializing in providing high quality and innovative financial advisory services to middle market companies. Services provided include merger, acquisition, and divestiture advisory services, the private placement of senior debt, subordinated/mezzanine debt, and equity capital, and general advisory services including business valuations, restructurings, and feasibility assessments. In order to assist MelCap Partners with securities related transactions, the investment bankers of MelCap are Registered Principals/Representatives of M&A Securities Group, Inc. (“MAS”), a FINRA broker-dealer firm.

About Globalscope Partners Ltd.

MelCap Partners is also a partner in Globalscope Partners Ltd., (www.globalscopepartners.com), an international M&A network with 55 firms in 47 countries. Globalscope is a leading group of investment bankers and business advisors supporting clients in domestic and international M&A transactions.